How to market your accountancy business

As an accountant, offering great services is only part of the equation. To grow your business, you need to market yourself. But with so many options, it can be tough to know where to start.

In this guide, I’ll walk you through some tried-and-true marketing strategies for accountants. From improving your online presence to building stronger client relationships, we’ll cover the steps you can take to get your business noticed and attract more clients.

TLDR: Accountancy marketing ideas for accountants

- Be visible both online (social media, SEO, review platforms) and offline (networking, word of mouth).

- Focus on SEO, mobile-friendliness, and easy contact options to boost visibility and user experience.

- Get listed and update your profile regularly to improve local SEO and attract more clients.

- Share helpful blogs, guides, and tax tips to establish authority and drive traffic.

- Tools like Synup, TaxDome, and Xero can streamline your processes, manage reviews, and help promote your services effectively.

If you want to connect with potential clients, you need to know where they spend their time both online and offline. Understanding where your audience hangs out is important to meet them where they are. Once you know this, you can make sure you're visible in the places that matter most.

Finding out where your clients are present

Online Channels: Most clients are online, so that’s where you need to be.

- Social Media: Platforms like LinkedIn, Facebook, and Instagram are great for building relationships and showcasing your expertise. People often use social media to find businesses and get updates.

- Search Engines: Clients are likely searching for accounting services on Google. SEO is crucial here, make sure your website is optimized to show up in the right searches.

- Finance-Specific Communities: Think Quora, Reddit, or financial blogs where people are asking questions and seeking advice. It’s a great place to show your knowledge and engage with potential clients directly.

Offline Channels: Even though online is big, offline channels still matter, especially for local businesses like yours.

- Networking Events: Get out there and connect with potential clients face-to-face. Industry events or local business meetups are perfect for making new connections.

- Traditional Advertising: Flyers, local newspapers, and even billboards can help spread the word, especially in communities where clients still trust print.

- Word of Mouth: Referrals go a long way. If you give great service, your current clients will tell others about you.

Lead them on the right discovery channels

Once you know where your clients are looking for accounting services, make it easy for them to find you.

Online: Focus on SEO, paid ads, and smart social media targeting to get in front of people when they’re searching for accounting help. Google My Business is a must, as it helps your local clients find you fast.

Offline: Attend local events, build relationships, and use print advertising strategically in your community. Also, encourage referrals by rewarding clients who send new business your way.

By aligning your strategy with where your clients are spending their time, both online and offline, you can make sure your accounting business is always top of mind when they need your services.

Ways to optimize your website for your accounting business

If you want your accounting business to stand out online, it’s crucial to make sure your website is optimized. Here’s how to do it.

1. Carry out keyword research

Start by researching the terms your potential clients are using to find accounting services. Think about keywords like “small business accountant,” “tax services,” or “financial planning for startups.” Use these terms throughout your website to ensure you're visible in search results.

2. Optimize your website content

Make sure your website’s page titles, descriptions, and headings are clear and include relevant keywords. This helps both search engines and visitors quickly understand what your business offers. For example, instead of just “Services,” try “Tax Preparation & Bookkeeping Services for Small Businesses.”

3. Make sure your website is mobile friendly

A mobile-friendly website is non-negotiable. Your clients need to be able to navigate your site easily from their phones. Also, speed matters - if your website takes too long to load, visitors will bounce. Use tools to test speed and optimize accordingly.

4. Use high-quality images and videos

Show your expertise by using professional images and videos that highlight your services. Consider adding a video that explains your accounting services or a testimonial from a satisfied client. This helps build trust and keeps visitors engaged.

5. Make it easy for them to contact you

Your website should make it super simple for potential clients to get in touch or schedule a consultation. Add a lead capture form that’s easy to fill out. Offer value in the form of a free consultation or downloadable resource, so visitors feel like they're getting something in return.

Top 10 marketing ideas to grow your accountancy business

1. Get Listed Online

Your potential clients are searching for accountants, and you want to make sure you show up when they do. Start by getting your business listed on major directories like Yelp, Google My Business, and Yellow Pages, as well as accounting-specific platforms like accountingmatch.com, cpadirectory.com, and cpafinder.com. Keep your information consistent across all sites, including your business category and any additional details like parking availability or handicap access.

2. Create a Google My Business Profile

Google My Business is essential for local SEO. A well-optimized Google listing can boost your visibility on search engines. Add your business info, post updates, share events, and promote blog content directly from your dashboard. This is a key tool to help you rank and get noticed by local searchers.

3. Build Your Authority with Content Marketing

Position yourself as an expert in the accounting field by creating helpful content. Blogging about common accounting issues, taxes, and financial tips can attract your target audience and improve your SEO. When done right, content marketing can generate leads and drive traffic to your site. Write about topics that your clients are curious about, like managing finances or tax-saving tips, and consider guest blogging to expand your reach.

4. Optimize Your Website for SEO

A search-engine-optimized website is crucial. Make sure your site is informative, user-friendly, and optimized for search engines. Use targeted keywords like “Best Accounting Firms in Atlanta” in your website copy, meta descriptions, and title tags. Don’t forget to optimize images with alt text and ensure your site is mobile-responsive.

5. Set Up a Facebook Business Page

Facebook remains one of the best platforms for local businesses. With over 2 billion active users, a Facebook business page allows you to engage with your audience through posts, events, and ads. It's also a great place to build an online reputation and get listed on directories.

6. Launch a Referral Program

Your existing clients can be your best marketing tool. Reward them for referring new clients with discounts, gift cards, or exclusive offers. A simple and effective referral program can boost your client base and strengthen relationships with current customers.

7. Manage Your Online Reviews

Online reviews are crucial for reputation management. Encourage satisfied clients to leave reviews on platforms like Yelp and Google. Respond promptly to both positive and negative feedback to show that you value client opinions. Automate your review management to keep track of mentions and build a positive online image.

💡: Here’s a collection of review request templates you can use when responding to reviews, tailored to different categories, response types, and tones.

8. Use Local Bulletins for Promotion

Take advantage of community bulletin boards to advertise your services. Create an eye-catching poster and place it in local businesses like coffee shops and grocery stores. It’s a simple yet effective way to increase visibility in your community.

9. Create a Holiday Marketing Calendar

Plan your marketing efforts around holidays when clients might need your services the most. For example, during the holiday season, create blog posts that help clients manage their spending and taxes. This keeps your firm top-of-mind during key times of the year.

10. Sponsor Local Events

Supporting community events can increase your visibility and enhance your reputation. Consider sponsoring local charity events, volunteering at career fairs, or offering financial workshops at schools. These efforts not only give back to the community but also position your firm as a trusted, community-focused business.

Top 4 tools that will help with promoting your accountancy business

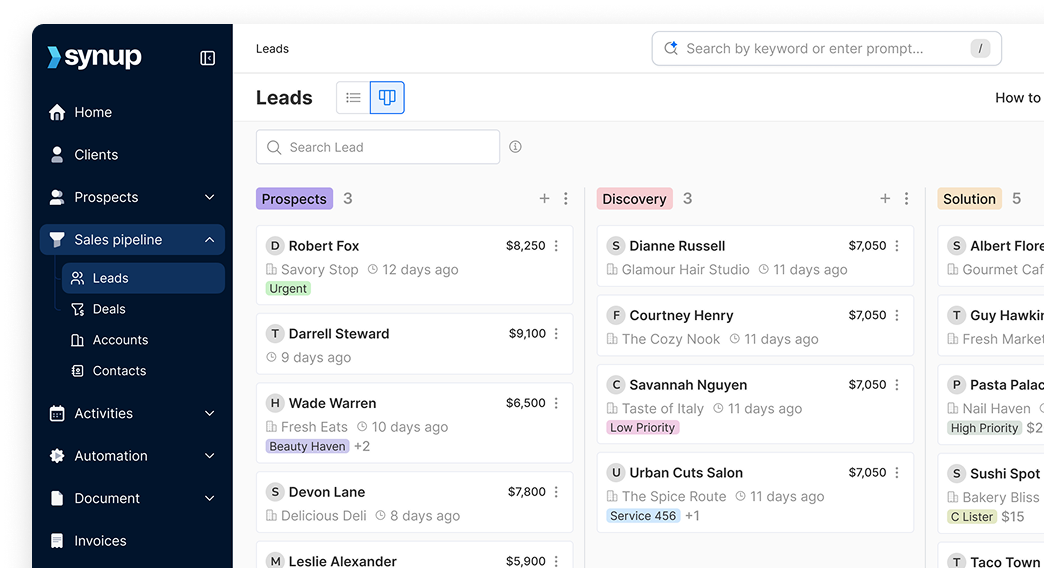

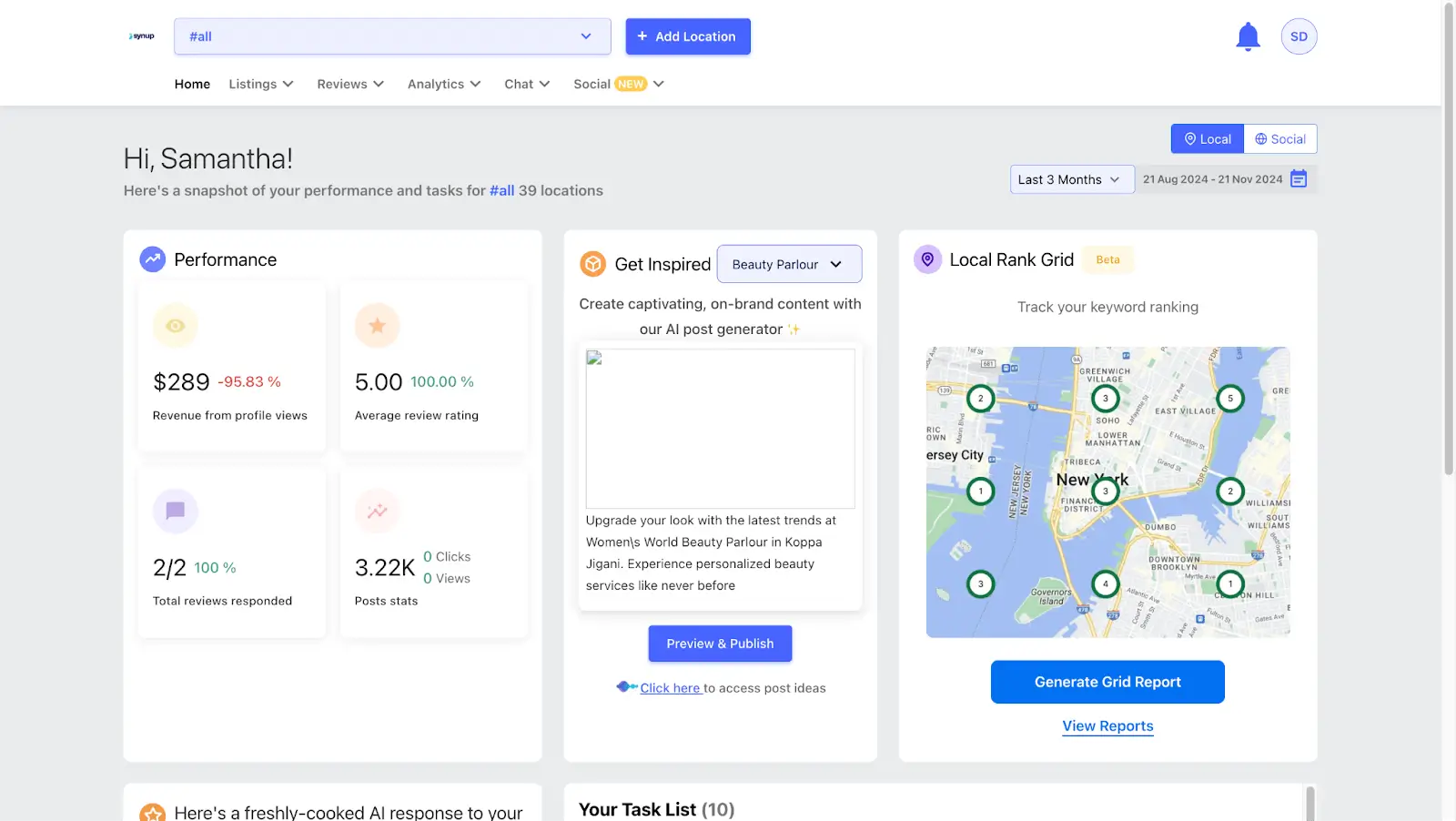

1. Synup

Synup is a comprehensive local listing and reputation management platform that helps accounting firms improve their online presence, manage their business information across directories, and maintain a positive reputation. It's specifically designed to help businesses like accounting firms stay visible, engage with clients, and improve their local search rankings.

Features

- Synup helps you manage your business information (name, address, phone number, etc.) across 70+ local directories, ensuring accuracy and consistency, which is crucial for local SEO.

- With Synup, you can monitor reviews from various platforms (Google, Yelp, Facebook, etc.), respond to them directly, and track client sentiment. This helps build trust and improve your firm's online reputation.

- The platform provides detailed reports and insights into your online performance, allowing you to track how your listings and reviews are impacting your business.

- Synup also helps accountants manage their social media presence by allowing easy posting and tracking of engagement, helping to keep your audience engaged with relevant content.

- For accounting firms offering services to clients, Synup offers white-label solutions, enabling firms to provide listing management and reputation services under their own brands.

2. TaxDome

TaxDome is an all-in-one practice management software designed specifically for accounting firms. It helps accountants manage workflows, communications, and documents in one place.

Features

- A customizable portal where clients can securely upload documents, sign agreements, and track the progress of their filings. This streamlines communication and adds a professional touch.

- Automate repetitive tasks, like sending reminders for tax deadlines, document requests, and payment reminders, ensuring clients stay engaged.

- You can send email campaigns and newsletters directly to clients, promoting your services or providing updates on tax laws and deadlines.

- Customize the platform with your firm's branding, ensuring consistency across all client-facing materials.

3. Xero

Xero is a popular cloud-based accounting software that provides a range of tools for accountants to manage client accounts and promote their services.

Features

- Create professional invoices and offer clients a simple way to pay online, making your services look professional and convenient.

- This is Xero’s educational hub that provides accountants with resources to enhance their knowledge and marketing efforts. Accountants can use this platform to learn about trends, updates, and best practices to help market their services.

- Share financial data with clients in real-time, offering advice and insights directly through the platform, which can help build client trust.

- Xero integrates with marketing tools like Mailchimp, allowing you to sync your client contacts and send targeted campaigns.

4. Client Hub

Client Hub is a client portal designed to simplify client communication for accountants. It focuses on enhancing the client experience while making it easier for accountants to manage client information and marketing efforts.

Features

- Clients can easily upload sensitive documents securely. This is essential for maintaining client trust and ensuring compliance with data protection regulations.

- All client communications are logged, helping you stay organized and keeping a history of conversations for future reference.

- Simplifies billing by enabling clients to pay their invoices directly through the portal, improving cash flow and reducing late payments.

- The dashboard gives clients a clear view of their accounts, making it easier for them to engage with you. This enhances client satisfaction and boosts retention.

FAQs

- How do accountants market their business?

Accountants can market their business by building a strong online presence, staying active on social media, getting good reviews, and making sure their website ranks in local searches so potential clients can find them easily.

- How do I sell my accounting firm?

To sell your firm, you’ll need to highlight what makes it valuable, things like your client base, reputation, and financial stability. Working with a business broker or merging with another firm can also make the process smoother.

- How do I grow my accounting business?

Growing your business means bringing in more clients through referrals, offering specialized services, improving your online presence, and delivering excellent service to keep clients coming back.

- How to market yourself as an accountant?

Market yourself by having a solid website, building connections on LinkedIn, sharing helpful tips on social media, and asking happy clients for reviews to boost your credibility and attract more clients.